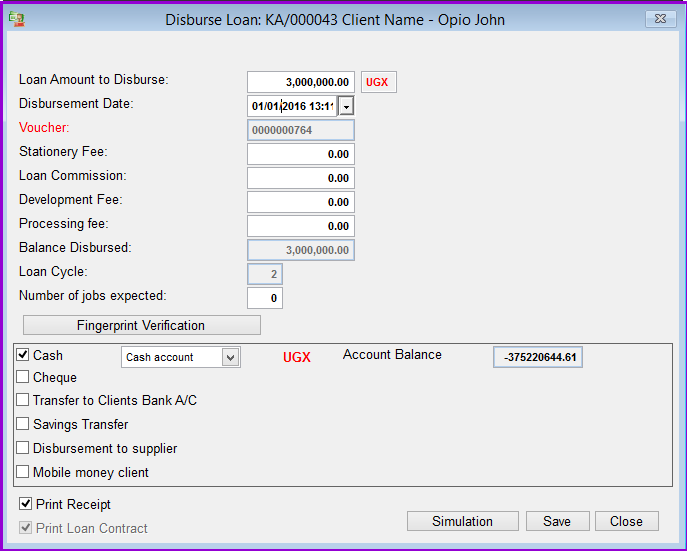

This window enables you to disburse loans that have been approved. After the loan is approved and all other fees (if any) are paid, the loan is then ready for "Disbursement".

How do you disburse a loan

To disburse a loan you go to Loans/Disbursement and the following dialog box appears:

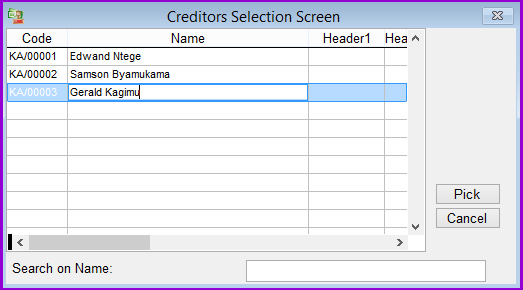

Click on the Choose button to select the Loan Number you want to disburse from the grid e.g. "KA/000043". Then click on Next to continue, the following screen appears:

Transfer to client's bank account: Select this option to transfer the loan to the client's bank account. When this option is selected the following screen appears:

The Nº 1 Software for Microfinance